Wealthy.in, India’s fast-growing wealth-tech platform for mutual fund distributors and wealth professionals, has raised ₹130 crore in its latest Series B round led by Bertelsmann India Investments. The round also saw participation from existing investor Alphawave Global, new investor Shepherd’s Hill, and several prominent tech entrepreneurs.

Rapid Growth Across India’s Expanding Wealth Market

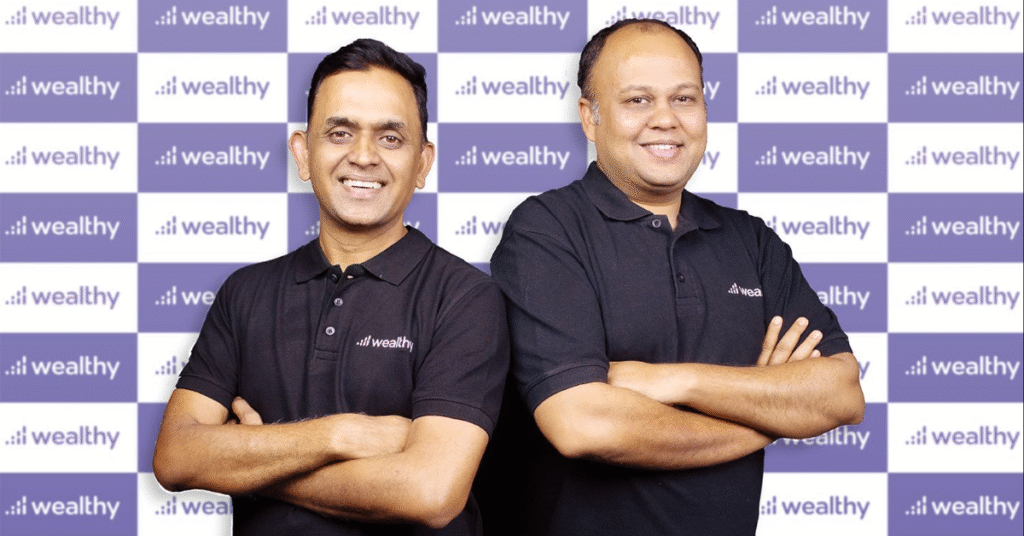

Founded by IIT–IIM alumni Aditya Agarwal and Prashant Gupta, Wealthy has built one of India’s most active wealth distribution networks. The platform processes ₹300 crore in monthly transactions, works with 6,000+ mutual fund distributors, and serves 100,000+ clients across more than 1,000 towns. Its AUM has surged from ₹200 crore to ₹5,000 crore over the last three years, reflecting the accelerated shift toward managed investments.

Wealthy currently operates through 20 offices nationwide, backed by a 250+ member team, and is the second-largest recruiter of distributors in India, adding 350+ every month.

Fresh Capital to Power AI, Expansion, and 50,000 New MFDs

The newly raised funds will help Wealthy invest deeper into AI-led advisory tools, expand into Tier 2 and Tier 3 markets, and enable 50,000 distributors to scale their businesses. The long-term goal: reach ₹1 lakh crore in AUM.

As India’s wealth management market moves toward a projected ₹200 lakh crore by FY29, independent MFDs have become the backbone of retail investing. Yet most lack technology, automation, and product access needed to match institutional players.

Closing India’s ‘Advice Gap’

“India has a fundamental advice gap that technology alone cannot solve,” said Aditya Agarwal, Co-founder of Wealthy. “We’ve built a mobile-first solution that combines human trust with AI-powered workflows, helping advisors deliver institutional-quality service at scale.”

Co-founder Prashant Gupta added, “A new generation of wealth entrepreneurs is emerging across India. Wealthy equips them with tools across all asset classes mutual funds, equities, fixed income, PMS, AIFs, insurance and enables them to build long-term equity as independent business owners.”

Investor Confidence in India’s Wealth-Tech Moment

Highlighting the long-term opportunity, Rohit Sood, Partner at Bertelsmann India Investments, said, “With less than 15% of Indian households participating in equities, Wealthy will play a vital role in driving financial inclusion as markets mature.”

AI at the Core of Wealthy’s Platform

Wealthy offers:

- AI-powered advisory workflows

- 2-minute digital onboarding & KYC

- Enterprise-grade distributor tools

- Data-driven insights and analytics

As India’s investment landscape deepens, Wealthy aims to build the country’s most powerful, technology-driven ecosystem for wealth partners and their clients.

Keep building. Keep learning. Keep growing with StartupByDoc.