Deeptech Capital in India Is Shifting From Experiments to Scale

As India pushes to build strategic depth in semiconductors, spacetech, and AI infrastructure, venture capital is steadily moving away from application-led bets toward foundational technologies. Rising compute demand, energy constraints, and geopolitics are forcing investors to think long-term, backing companies that can own critical infrastructure rather than short-term SaaS cycles.

Fund Close Snapshot

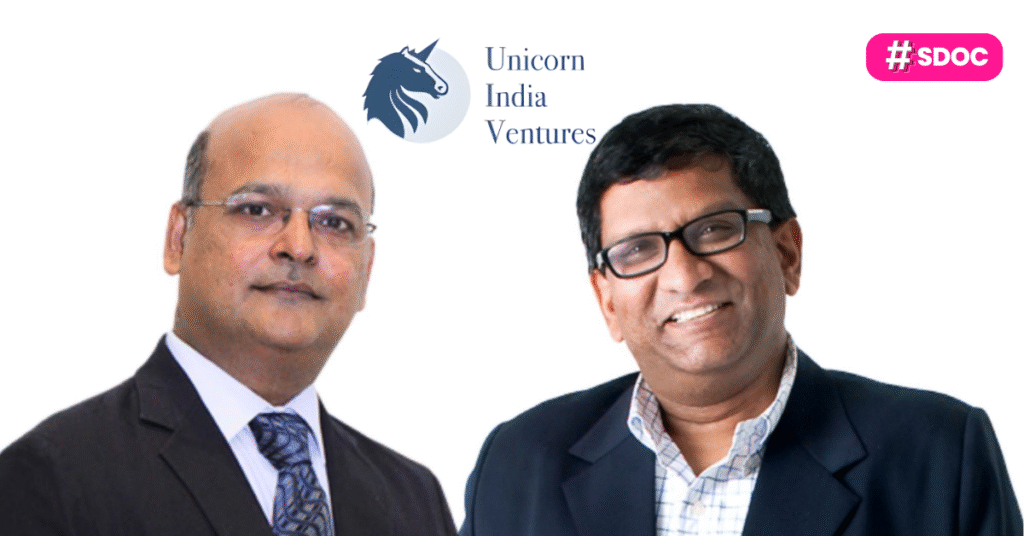

Mumbai-based deeptech-focused VC firm Unicorn India Ventures has closed its third fund at ₹1,200 crore, exceeding its initial target of ₹1,000 crore.

Limited partners in Fund III include HNIs, UHNIs, family offices, and institutions such as SIDBI, State Bank of India, NABARD, and the state governments of Kerala, Madhya Pradesh, and Odisha.

Investment Focus and Strategy

Fund III is focused squarely on semiconductors, spacetech, and AI infrastructure, with the firm consciously staying away from AI application-layer SaaS. Instead, Unicorn India Ventures is backing enabling layers such as chips, data centres, power systems, and core infrastructure, including early exploration into nuclear micro power generation as a future AI enabler.

The fund plans to make around 20 investments, with an average ticket size of ₹10–15 crore, and expects to announce four new investments shortly across quantum sensing, agritech, and spacetech.

Early Traction and Portfolio Signals

The firm claims strong early momentum, with 7–8 portfolio companies already raising follow-on rounds. Across its three funds, Unicorn India Ventures has backed nearly 50 startups, with a combined portfolio valuation of about $5 billion. Notably, several Fund III companies are led by academicians, reflecting a growing pipeline of research-led founders entering India’s startup ecosystem.

Keep building. Keep learning. Keep growing with StartupByDoc.