The world’s richest families are not just wealthy. They are institutions of power, legacy, and long-term influence. Built over decades and, in some cases, centuries, these dynasties control global retail chains, oil reserves, luxury fashion houses, media empires, and diversified conglomerates.

According to Bloomberg, the combined wealth of the top 25 richest families has surged to $2.9 trillion, rising by $358.7 billion in just one year. Among the global elite, only one Indian family, the Ambanis, has secured a place in the top 10, highlighting India’s rare representation in the world’s wealthiest dynasties.

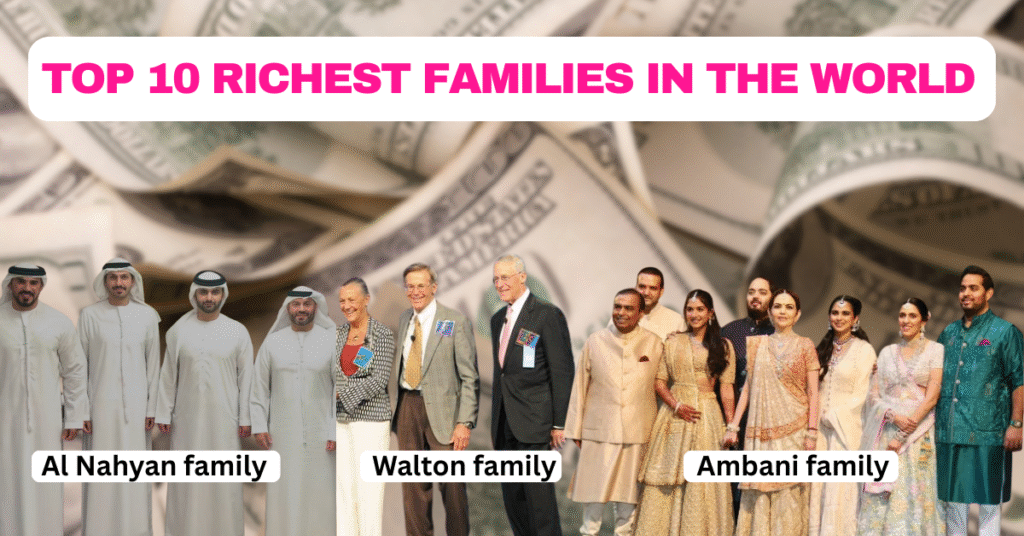

Here is a closer look at the Top 10 richest families in the world right now.

Top 10 Richest Families in the World

| Rank | Family | Net Worth | Key Industries |

|---|---|---|---|

| 1 | Waltons | $513.4B | Walmart retail |

| 2 | Al Nahyan | $335.9B | UAE ruling family, investments |

| 3 | Al Saud | $213.6B | Oil, infrastructure |

| 4 | Al Thani | $199.5B | Gas, real estate, luxury |

| 5 | Hermès | $184.5B | Luxury fashion |

| 6 | Koch | $150.5B | Oil, chemicals, conglomerate |

| 7 | Mars | $143.4B | Chocolate, pet care |

| 8 | Ambani | $105.6B | Oil, telecom, retail |

| 9 | Wertheimer | $85.6B | Chanel fashion |

| 10 | Thomson | $82.1B | Media, investments |

Waltons: The Retail Kings of the World

At the very top sits the Walton family, owners of Walmart, with a staggering $513.4 billion net worth. Controlling about 44% of Walmart, the family oversees more than 10,750 stores globally. With Walmart generating $681 billion in revenue last fiscal year, the Waltons remain unmatched in scale, efficiency, and retail dominance.

Al Nahyan: Abu Dhabi’s Old-Money Powerhouse

The Al Nahyan family of Abu Dhabi holds wealth worth $335.9 billion, rooted in political authority and long-term investment strategy. Their influence extends far beyond oil into real estate, banking, and global enterprises, making them one of the most stable dynastic fortunes in the world.

Al Saud: Saudi Arabia’s Oil-Driven Royal Wealth

With an estimated $213.6 billion, the Al Saud family derives much of its wealth from Saudi Arabia’s oil dominance via Saudi Aramco. Through the Public Investment Fund, the family is now diversifying aggressively into tourism, infrastructure, and global ventures, signaling a strategic shift beyond oil.

Al Thani: Qatar’s Gas-Fueled Global Investors

The Al Thani family of Qatar commands $199.5 billion, largely built on massive offshore gas reserves. Their global footprint includes marquee assets such as Harrods in London and Valentino, blending political power with international luxury investments.

Hermès: Six Generations of Luxury Excellence

The Hermès family has preserved and grown its $184.5 billion fortune by staying fiercely committed to craftsmanship. Famous for Birkin and Kelly bags, the family has resisted mass-market expansion, proving that scarcity and heritage can outperform scale in luxury.

Koch: America’s Largest Private Industrial Empire

The Koch family transformed a modest oil refinery into a $150.5 billion industrial powerhouse. With interests spanning chemicals, fertilizers, electronics, and manufacturing, Koch Industries stands as one of the largest privately held companies in the US.

Mars: Quiet Giants of Chocolate and Pet Care

Worth $143.4 billion, the Mars family dominates both confectionery and pet care. Brands like M&M’s, Snickers, and Pedigree fuel steady growth, supported by strategic acquisitions such as Kellanova in 2025, reinforcing their global snack leadership.

Ambani: India’s Only Global Wealth Dynasty

The Ambani family, with a net worth of $105.6 billion, is the only Indian family in Bloomberg’s top 10. Under Mukesh Ambani, Reliance Industries has evolved from textiles into energy, telecom, retail, and consumer products. Today, the next generation is actively shaping the group’s future, making the Ambanis a symbol of modern Indian enterprise on the world stage.

Wertheimer: The Guardians of Chanel

The Wertheimer family, heirs to Chanel, controls a $85.6 billion fashion empire. From the iconic No. 5 perfume to the little black dress, Chanel continues to thrive under tight family ownership and timeless brand power.

Thomson: Canada’s Media and Data Dynasty

With $82.1 billion, the Thomson family owns Thomson Reuters and a wide portfolio of investments via Woodbridge. Blending journalism, financial data, real estate, and art, the family has modernised a media legacy into a diversified global powerhouse.

The Bigger Picture

These families represent a mix of old royalty, inherited craftsmanship, and modern industrial ambition. Their influence stretches far beyond balance sheets, shaping industries, employment, and even geopolitics.

One fact stands out clearly.

Among the world’s richest dynasties, India has just one seat at the table.

Source: Bloomberg

Keep building. Keep learning. Keep growing with StartupByDoc.