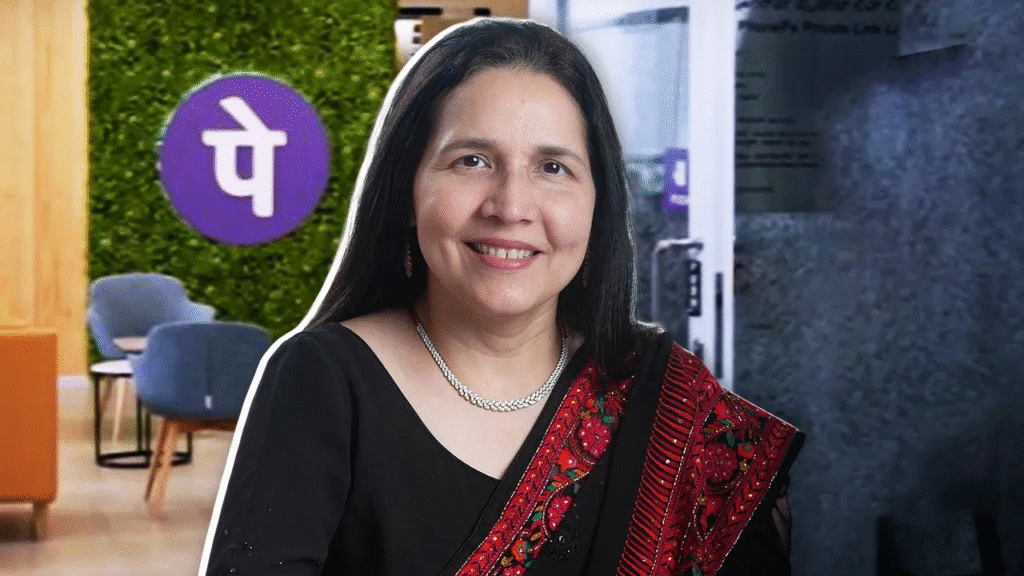

Bengaluru-based UPI payments leader PhonePe has made a strategic addition to its board of directors by onboarding Zarin Daruwala, former CEO of Standard Chartered India and South Asia. This key appointment underscores the fintech giant’s growing emphasis on corporate governance and leadership stability as it prepares for an eventual public listing.

Banking Muscle for the Boardroom

Daruwala, who stepped down from her Standard Chartered role in April 2024, brings over 30 years of experience in banking and finance. Prior to her nine-year stint at Standard Chartered, she spent 26 years at ICICI Bank, serving in multiple leadership roles across corporate banking, agri-business, and rural finance.

Her appointment has already been updated on PhonePe’s official website, signaling formal board inclusion.

Why it matters: With an IPO on the horizon, Daruwala’s deep industry expertise is expected to fortify PhonePe’s strategic direction, risk oversight, and financial governance.

IPO Readiness in Motion

While PhonePe has not set a specific IPO date, the company began groundwork as early as February 2024. Steps taken to become IPO-compliant include:

- Corporate Rebranding: Shareholder approval in April to change the name from PhonePe Private Limited to PhonePe Limited.

- KMP Designation: Appointment of top leadership as Key Managerial Personnel (KMP) under listing norms:

- Sameer Nigam, CEO

- Rahul Chari, CTO

- Adarsh Nahata, CFO

- Ankit Popat, Company Secretary

A High-Profile Board

Zarin Daruwala joins a power-packed board that already features:

- Manish Sabharwal, Founder, Teamlease

- Rohit Bhagat, Former BlackRock Executive

- Tarun Chugh, Ex-IAS Officer

- Walmart executives John David Rainey, Donna Morris, and Leigh Hopkins

- PhonePe co-founders Sameer Nigam and Rahul Chari

This diverse board composition blends tech, finance, public policy, and global corporate governance.

Financial Turnaround and Market Leadership

PhonePe has been on a strong upward trajectory:

- UPI Market Share (FY24):

- PhonePe: 47%

- Google Pay: 37%

- Paytm: 6%

- FY24 Financials:

- Revenue: ₹5,064 crore (up 73% YoY)

- Profit After Tax: ₹197 crore (vs ₹738 crore loss in FY23)

In December 2022, PhonePe also relocated its domicile from Singapore to India, reportedly incurring an ₹8,000 crore tax bill, aligning itself with Indian tax laws ahead of its public debut.

What This Signals

- Governance Upgrade: Daruwala’s addition reinforces a shift from startup agility to enterprise-scale governance.

- IPO Momentum: Every move—from leadership structuring to domicile shift—aligns with SEBI norms for public companies.

- Investor Confidence: Strong financials and a seasoned board are likely to attract institutional interest when the IPO launches.