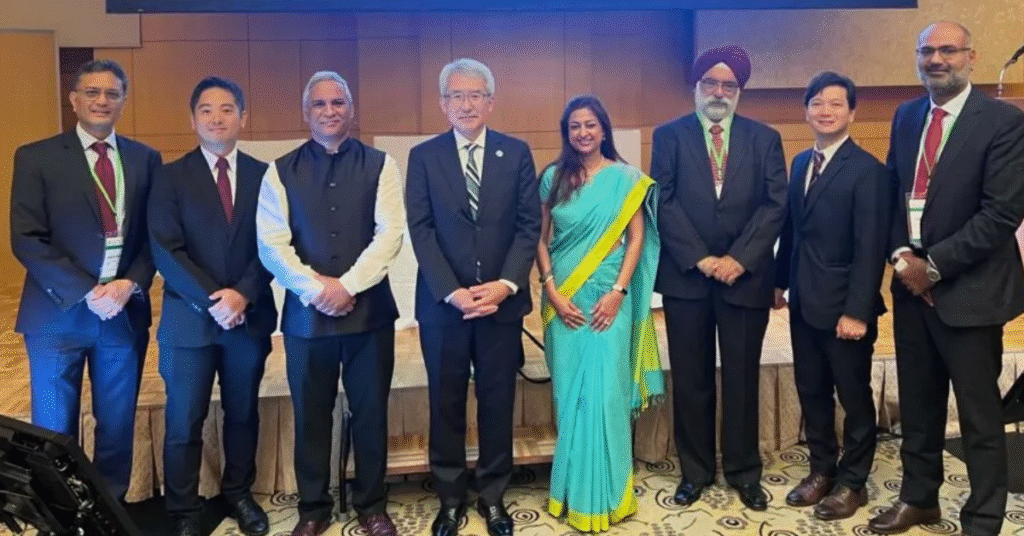

Japan International Cooperation Agency (JICA), Japan’s official development assistance body, has committed $40 million to Aavishkaar Capital’s ‘Global Supply Chain Support Fund’ to drive inclusive and sustainable growth across Asia and Africa. The announcement was made by Japanese Prime Minister Shigeru Ishiba at the “Economic Partnership in Indian Ocean – Africa Forum.”

The fund, managed by impact-focused Aavishkaar Capital, will leverage JICA’s contribution to provide credit to private corporations in India, Africa, and other emerging Asian markets. These businesses span agriculture, food processing, and manufacturing sectors and play a crucial role in international supply chains. The initiative specifically targets small and medium-sized enterprises (SMEs) with strong social and environmental impact.

Aavishkaar Capital, known for investing in the Global South, has already made eight investments across Asia and Africa through the Global Supply Chain Support Fund. The firm’s portfolio emphasizes sustainable agriculture, financial inclusion, and essential services, balancing commercial returns with measurable social outcomes.

JICA’s investment enables the fund to expand beyond India, strengthening enterprises that contribute to the wider Indian Ocean region’s economic development and the global supply chain ecosystem. For Aavishkaar Capital, this marks a strategic step toward scaling impact across emerging markets, while reinforcing ESG-focused investment as a driver of sustainable growth.

With approximately $550 million in assets under management across eight funds, Aavishkaar Capital demonstrates how impact investing can align financial returns with positive social and environmental outcomes. The Global Supply Chain Support Fund represents a blueprint for supporting SMEs that are both commercially viable and socially responsible, bridging the gap between capital and sustainable development in Asia and Africa.

Follow StartupByDoc for the latest updates on impact investing, emerging market startups, and global growth opportunities.”