Embedded Credit Is Becoming Core to MSME Growth

India’s MSMEs continue to face structural gaps in access to timely, affordable credit. While digital merchant platforms have scaled rapidly, lending often remains a separate, friction-heavy process. This has accelerated interest in embedded finance models, where credit is offered contextually at the point of need, using transaction data and automated underwriting rather than collateral-heavy assessments.

Funding Snapshot and Capital Deployment

Mumbai-based embedded lending technology startup Intellend Technologies Advisors has raised $1.2 million (around ₹10.6 crore) in a seed funding round led by Incubate Fund Asia. The round also saw participation from M Venture Partners, Atrium Angels, and angel investor Dhananjay Tiwari.

The proceeds will be used to expand the core team, enhance product capabilities, and execute Intellend’s go-to-market strategy.

What Intellend Is Building

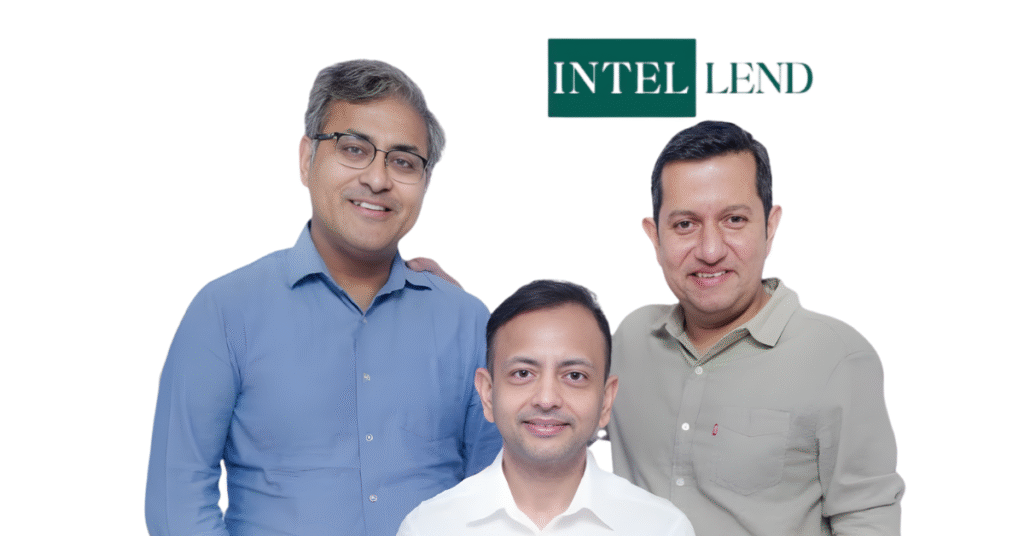

Founded in May 2025 by Brotish Das, Som Chatterjee, and Bodhisattwa Gupta, Intellend is building a full-stack lending-as-a-service platform that enables embedded credit for MSMEs within digital merchant ecosystems. Its platform allows merchant platforms and financial institutions to offer loans seamlessly at the point of need, powered by data-driven underwriting and automated risk assessment. Intellend has already partnered with merchant ecosystems serving over one lakh merchants, focusing on structured credit access for small businesses typically underserved by traditional lenders.

Why This Funding Matters

As embedded finance moves from experimentation to infrastructure, platforms like Intellend are positioning themselves as the credit layer inside India’s digital commerce stack. With a founding team that brings experience from institutions such as Citi, Standard Chartered, HSBC, and Axis Bank, Intellend’s approach reflects a broader trend of combining regulated lending expertise with modern API-led distribution. For Indian fintech founders, the signal is clear: solving MSME credit will increasingly depend on where lending is embedded, not just who provides it.

Keep building. Keep learning. Keep growing with StartupByDoc.