Strong Investor Response

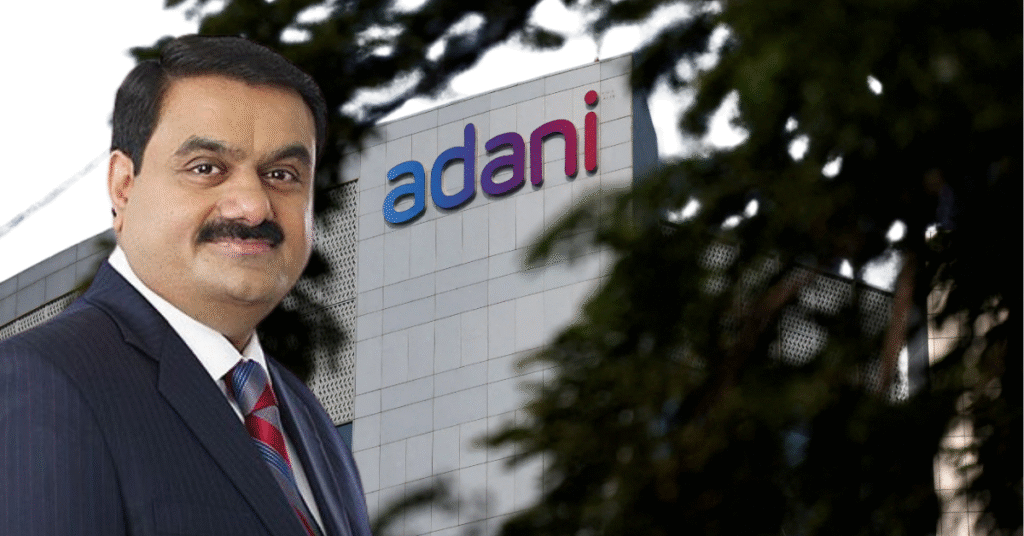

Adani Enterprises Limited’s ₹1,000 crore public issue of non-convertible debentures (NCDs) was fully subscribed within 45 minutes of opening, according to stock exchange data. The base issue of ₹500 crore was fully taken up in just 10 minutes, with subscriptions crossing the ₹1,000 crore mark after including the greenshoe option.

Issue Structure and Timeline

The NCD issue opened on Tuesday and will close on January 19, 2026. Allotment will be carried out on a first-come, first-served basis. The issue comprises a base size of ₹500 crore with a greenshoe option of an additional ₹500 crore.

Yield and Ratings

The NCDs offer an effective yield of up to 8.90 percent per annum, depending on the chosen series and tenure. The instruments are rated ‘AA-’ with a stable outlook by ICRA and CARE Ratings, positioning them competitively against similarly rated corporate debt and fixed deposit products.

Use of Proceeds

According to the company, at least 75 percent of the proceeds will be used to repay existing debt, while the remaining portion may be deployed for general corporate purposes. The NCDs are proposed to be listed on both BSE and NSE.

Investor Confidence and Track Record

This is AEL’s second public NCD issuance in recent months. Its ₹1,000 crore NCD issue in July 2025 was fully subscribed within three hours on the first day, underscoring sustained investor appetite for the company’s debt offerings.

Tenors and Series

The current issue offers tenors of 24, 36 and 60 months, with quarterly, annual and cumulative interest payment options spread across eight series, catering to different investor preferences.

Business Context

AEL continues to expand its infrastructure portfolio, including the Navi Mumbai International Airport, the Google–Adani AI data centre campus in Visakhapatnam, and multiple road and ropeway projects across India. The strong response to the NCD issue reflects investor confidence in the company’s execution capability and infrastructure-led growth strategy.

Keep building. Keep learning. Keep growing with StartupByDoc.