India’s startup ecosystem ended 2025 at a crucial transition point. Total venture funding declined to $13 billion, nearly 10% lower than 2024, as global risk appetite softened and the number of late-stage mega rounds fell. However, the slowdown masked deeper structural strength within the ecosystem, including record IPO activity, selective capital deployment, and sharper operational discipline across startups.

Importantly, funding levels stayed well above 2023’s $11.3 billion, widely regarded as the ecosystem’s coldest phase, reinforcing that 2025 represented consolidation rather than contraction.

Funding Overview: Cooling Capital, Not Confidence

| Year | Total Funding |

|---|---|

| 2023 | $11.3 Bn |

| 2024 | $14.4 Bn |

| 2025 | $13.0 Bn |

Investor caution in 2025 stemmed less from capital scarcity and more from higher quality thresholds. Profitability timelines, governance readiness, and IPO potential became central to funding decisions. Despite tighter scrutiny, Indian startups closed 1,250 deals, indicating sustained entrepreneurial momentum.

Stage-wise Funding: Capital Concentrates at the Top

| Stage | Capital Raised | Deals |

|---|---|---|

| Early Stage | $3.2 Bn | 831 |

| Growth & Late Stage | $9.86 Bn | 286 |

While early-stage deals dominated in volume, growth and late-stage startups captured most of the capital. Investors increasingly preferred de-risked scale while backing fewer, high-conviction early-stage companies, particularly in AI and healthtech.

Funding Through the Year: Volatility Shapes Sentiment

Funding activity in 2025 followed an uneven pattern. January opened strong at $1.76 billion, but funding dropped below $1 billion in seven months. Short-lived recoveries in September and October were driven by individual large rounds rather than broad-based confidence.

The year ended at $870 million in December, reflecting cautious year-end deployment amid macro uncertainty.

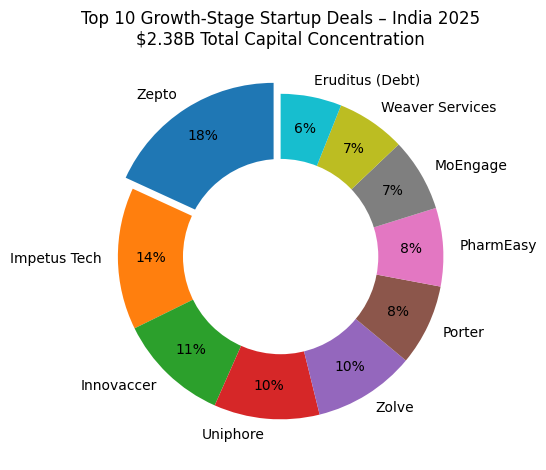

Growth-Stage Capital: Big Bets Still Found Takers

Despite the broader slowdown, select startups continued to attract sizeable growth-stage cheques. Investor appetite remained strongest for AI-led platforms, enterprise SaaS, logistics, and scaled consumer brands with clear revenue visibility and paths to profitability.

Growth-stage funding in 2025 was highly concentrated, with nearly one-fifth of capital flowing into a single startup and the majority directed toward proven, scale-ready companies.

Early-Stage Capital: Conviction Over Volume

Early-stage funding in 2025 reflected sharper selectivity. Healthtech and AI-first startups continued to draw investor interest, while experimental and low-moat models struggled to secure capital.

| Startup | Segment | Amount |

|---|---|---|

| PB Healthcare | Healthtech | $218 Mn |

| QWEEN | D2C | $110 Mn |

| Giga, Composio, Mem0 | AI | $110+ Mn (combined) |

The trend suggests early investors are backing fewer companies, but with greater confidence and larger average cheque sizes.

Strategic M&A: Scale, Not Survival

Mergers and acquisitions in 2025 were largely strategic, as incumbents and private equity-backed platforms acquired proven startups to strengthen technology, distribution, or market access.

| Deal | Value |

|---|---|

| HUL–Minimalist | $350 Mn |

| Everstone–Wingify | $200 Mn |

| Delhivery–Ecom Express | $166 Mn |

Consumer, SaaS, logistics, fintech, and gaming led consolidation activity throughout the year.

H1 vs H2: Funding Momentum Softens

While headline funding totals appeared evenly split, the character of activity changed materially between the two halves of the year.

| Metric | H1 2025 | H2 2025 |

|---|---|---|

| Total Funding | $6.72 Bn | $6.34 Bn |

| Number of Deals | 626 | 624 |

| $100M+ Rounds | 12 | 10 |

| M&A Transactions | 85 | 47 |

| Layoffs Impacted | 1,000+ | 2,800+ |

H1 benefited from residual optimism carried over from late 2024, reflected in higher M&A volumes and more large funding rounds. In contrast, H2 saw weakening conviction, fewer large deals, and a noticeable rise in layoffs as startups tightened costs amid uneven revenue growth.

IPOs Redefine the Exit Landscape

The most decisive signal of ecosystem maturity in 2025 was the surge in startup IPOs, which rose to 18 listings, up from 13 in 2024. Consumer internet, fintech, SaaS, and EV startups together raised nearly ₹41,000 crore, creating meaningful liquidity for founders, employees, and early investors.

This shift also explains the sharp drop in ESOP buybacks, which fell to around $65 million, as liquidity increasingly moved from private programmes to public markets.

Layoffs and Shutdowns: Discipline Deepens

Layoffs in 2025 affected around 3,800 employees across 24 startups, significantly lower than the mass cuts seen during the 2022–23 correction. However, 28 startup shutdowns were recorded, the highest in three years, signalling reduced tolerance for sub-scale or unsustainable business models.

Outlook: Why 2026 Could Mark a Turn

While 2025 did not deliver a funding surge, it played a critical role in resetting expectations. India’s startup ecosystem is transitioning from capital-led growth to execution-led scale, with IPOs emerging as the most credible exit pathway.

As the next cohort of post-2015 and post-2020 startups matures and domestic liquidity continues to anchor public markets, 2026 could mark the return of stronger, more disciplined funding cycles.

Keep building. Keep learning. Keep growing with StartupByDoc.