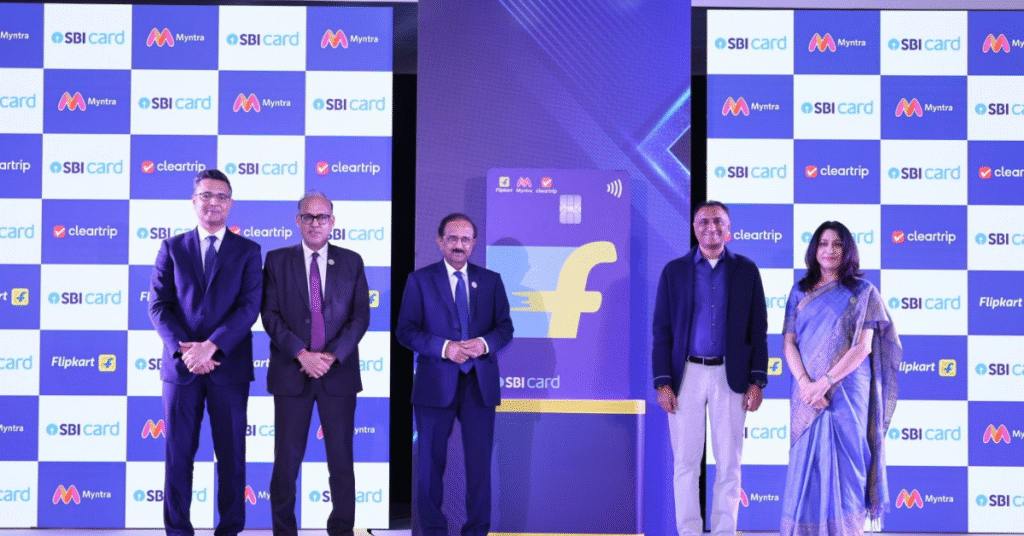

In a move to deepen consumer engagement across India’s booming e-commerce market, SBI Cards and Payment Services and Flipkart have jointly launched the Flipkart SBI Credit Card, offering high-value rewards and digital-first convenience.

Exclusive Cashback Benefits

The new card brings a strong value proposition for online shoppers:

- 7.5% cashback on Myntra purchases

- 5% cashback on Flipkart, Shopsy, and Cleartrip

- 4% cashback on select partners like Zomato, Uber, Netmeds, and PVR

- 1% unlimited cashback on other eligible transactions

- 1% fuel surcharge waiver (up to ₹400 per cycle)

Customers can apply digitally through the Flipkart app or SBI Card’s website, with quarterly cashback limits of ₹4,000 per category.

Value Beyond Cashback

Priced at ₹500 annual fee, the card unlocks ₹1,250 welcome benefits via e-gift cards and Cleartrip vouchers. Renewal fee is waived off on annual spends above ₹3.5 lakh. Cashback is auto-credited within two days of statement generation.

Additionally, Flipkart and SBI Card have launched a limited-time promotion, offering Samsung Galaxy smartwatches and Ambrane power banks to new applicants.

Leadership Speak

Salila Pande, MD & CEO of SBI Card, said the launch reflects the company’s focus on designing best-in-class products aligned with evolving consumer needs.

Flipkart Group CEO Kalyan Krishnamurthy added, “This card is a step towards democratising credit access and building innovative financial offerings for millions of Indians.”

Final Take

As India’s digital commerce ecosystem grows, co-branded credit cards like this highlight how financial services and retail can merge to deliver smarter, rewarding, and inclusive experiences

Will this card redefine the way Indians shop online? Share your thoughts with us at StartupByDoc.