New Delhi | July 30, 2025 — In a startup ecosystem where headlines are dominated by funding rounds and billion-dollar valuations, a silent revolution is underway. Indian founders are building resilient, profitable companies without raising a single rupee from venture capital.

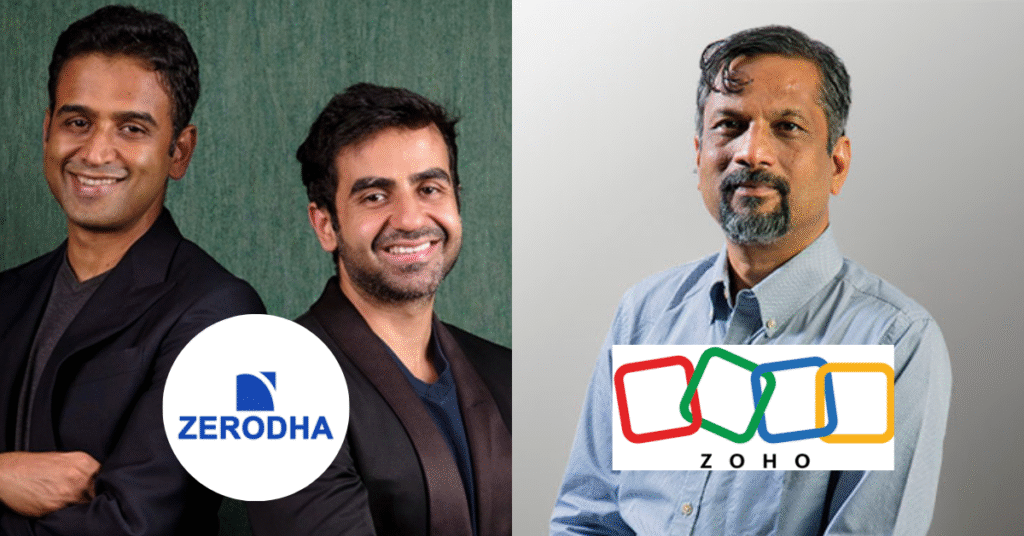

From the rural heartlands to mid-tier cities, stories of bootstrapped brilliance are emerging. At the forefront are companies like Zoho and Zerodha, two of India’s most successful startups that have grown entirely on their own terms.

Zoho and Zerodha: Building with Discipline

Sridhar Vembu, founder of Zoho, didn’t move to Silicon Valley for funding he moved to Tenkasi, a village in Tamil Nadu. There, he built a global SaaS powerhouse with more than 100 million users, without ever approaching a VC.

Similarly, Nithin and Nikhil Kamath, founders of Zerodha, bootstrapped their way to become India’s largest stock brokerage. Their success wasn’t built on flashy marketing or investor buzz it came from a deep understanding of customer pain points, product-led growth, and lean operations.

Both companies now stand as symbols of independence, profitability, and long-term vision.

A New Generation from Tier-2 India

This playbook isn’t limited to legacy names. Today, startups from cities like Indore, Udaipur, and Kochi are embracing the same mindset. B2B SaaS founders are self-funding via consulting income. D2C brands are scaling through customer referrals and operational efficiency instead of ad blitzes. Creators-turned-founders are launching productized tools for niche audiences—with zero outside capital.

Their approach is defined by:

- Revenue-first thinking: Instead of focusing on valuations, they focus on cash flow from day one.

- Customer obsession: Without investor pressure, these founders listen to their users more than boardrooms.

- Deliberate hiring: Rather than scaling fast, they hire thoughtfully and build strong, value-driven teams.

Why This Matters in 2025

As funding winters stretch longer and investor expectations tighten, bootstrapped companies are better positioned to weather volatility. They own their cap tables. They grow sustainably. And they can pivot faster without seeking approval from external stakeholders.

The irony? Many of these companies are now more attractive to acquirers not because they raised, but because they didn’t.

Final Take

Bootstrapping is not just a financial choice—it’s a philosophical one. It demands patience, discipline, and a long-term mindset. But as India’s quiet founders are proving, you don’t need capital to create impact. You need conviction, a clear problem to solve, and the resilience to keep showing up.

Know a founder who’s building without funding? Share this DOC Insider with them.

Explore more such grounded stories at StartupByDoc.com