Venture capital firm ValleyNXT Ventures has launched Bharat Breakthrough Fund–I, a SEBI-registered Category I venture capital fund, with a total corpus of ₹400 crore. The fund will focus on investing in seed to pre-Series A startups, particularly in deep-tech and technology-first sectors.

The fund aims to address a key gap in early-stage startup growth, where founders often struggle with fragmented mentorship, scaling pressure, and lack of execution support during the transition from validation to scale.

Fund Structure and Sector Focus

Bharat Breakthrough Fund–I has a base corpus target of ₹200 crore, along with a greenshoe option of an additional ₹200 crore. The fund will invest across emerging sectors including space technology, defence tech, robotics, AI and machine learning, cybersecurity, biotech, sustainability, and consumer innovation.

ValleyNXT said the fund will follow its proprietary MIB framework—Mentorship, Investment, and Business Connects—combining capital deployment with hands-on guidance and strategic support.

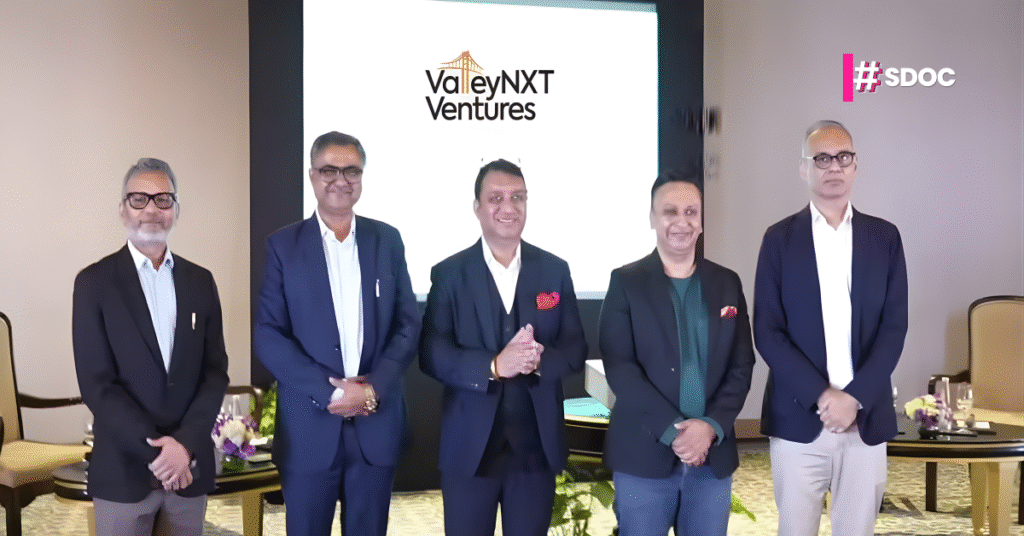

Leadership and Investment Track Record

The fund is led by Nikhil Agarwal, Madhu Vasepalli, Anand Saklecha, and Suresh Goyal, bringing experience across venture capital, governance, and deep-tech innovation. ValleyNXT Ventures has evaluated over 5,000 startup opportunities and invested in more than 10 early-stage ventures through its accelerator-driven model.

The launch reflects growing investor interest in India’s deep-tech ecosystem, where startups require longer development cycles and stronger institutional support.

Keep building. Keep learning. Keep growing with StartupByDoc.