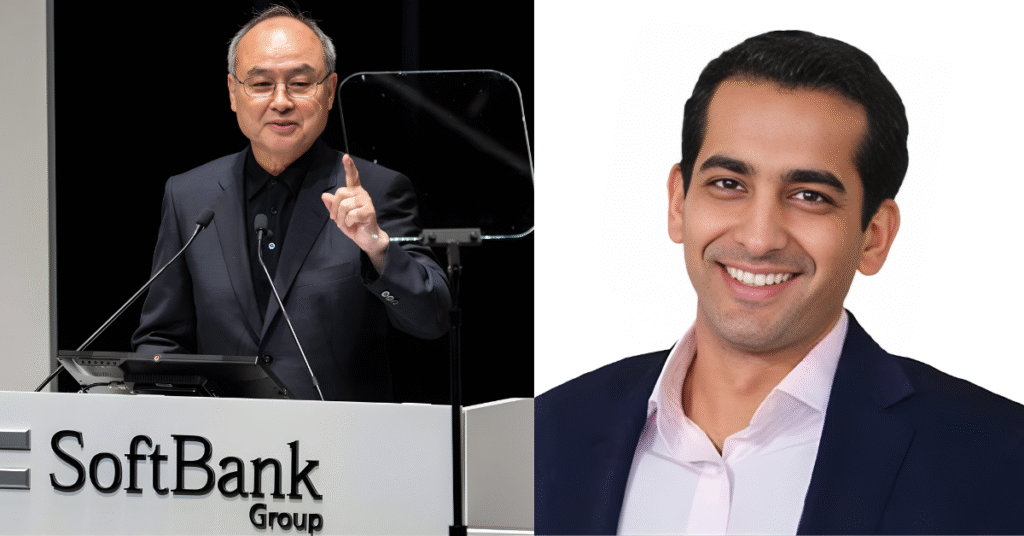

SoftBank is gearing up for a major return to India’s startup ecosystem, with fresh investments planned for 2026, according to Sumer Juneja, Managing Partner at SoftBank Investment Advisers. After a nearly three-year slowdown in new India deployments, Juneja confirmed that the Japanese investment giant is preparing to re-enter the market with renewed conviction.

In an interview with Moneycontrol, Juneja said SoftBank is “confident it will deploy capital” in India again and made it clear the firm has no intention of missing the next wave of startup growth. “We don’t want to be out of the game,” he said, emphasising that SoftBank is even willing to write smaller cheques to remain active: “We are not going to stay out of the market.”

SoftBank has not made any major new investments in India since 2022, except for a minority participation in fintech firm Juspay. While the fund continued follow-on investments—such as backing Meesho to maintain its stake—it largely stayed away from signing new deals. This drought is now coming to an end.

Juneja highlighted a strong resurgence in India’s startup pipeline, particularly in AI-driven businesses, signalling that SoftBank will prioritise artificial intelligence and adjacent technology themes going forward. He said the last 12 months have produced some of the “highest-quality founders” the firm has met in recent years.

He added that the fundraising landscape has changed since the 2023 slowdown, with founders becoming more capital efficient, raising fewer rounds and diluting less equity. At the same time, more startups are opting for public listings, offering faster liquidity to early investors. This has created a new dynamic where SoftBank now finds itself “competing with the IPO market” for deals.

Juneja views this shift positively for India’s startup ecosystem, noting: “The best thing you can do to any ecosystem is to give it more capital.”

SoftBank’s planned 2026 comeback signals a significant vote of confidence in India’s next phase of tech growth.

Follow Startupbydoc for daily startup insights, funding news, IPO analysis, and business breakdowns.